It was yet another very good week for the bulls in the stock market. More M&A activity and numerous economic data perceived as very good were the main factors. The markets remain in buy mode and look like they will continue at least until they have a reason bot to be. The skepticism from many investors about the rally is driving the markets more than the bears probably can fully comprehend. It is the Hungarian league that seems to have suffer the most. Tamás Scmidt having gains close to 200% has faced a serious draw down by not closing his short positions in CADCHF and CADJPY. A correction will certainly bring Mr. Schmidt back above the levels where he feels at home.

György Doleschall on his account BUX-Plussz III has faced a draw down as well. Mr. Doleschall ready for the weakening of the EM currencies is also playing on the weakening of the US dollar against the euro. As we all know a correction in the carry trades can be very powerful, so if one comes in the near future Mr. Doleschall will definitely revisit his highs. Patience has always proved to be a beneficial strategy as the former chess master explains.

Interesting to notice the strategy of Péter Dsupin. Mr.Dsupin is riding the up trend in the Dow and S&P indices, not afraid to buy at new highs when the trend is his friend. So far he only traded CFD indices, still long in Dow from 12500 Mr. Dsupin is not showing any signs of nervousness. It seems that his strategy is to cut the loss and let the profits run (well there was nothing to cut so far).

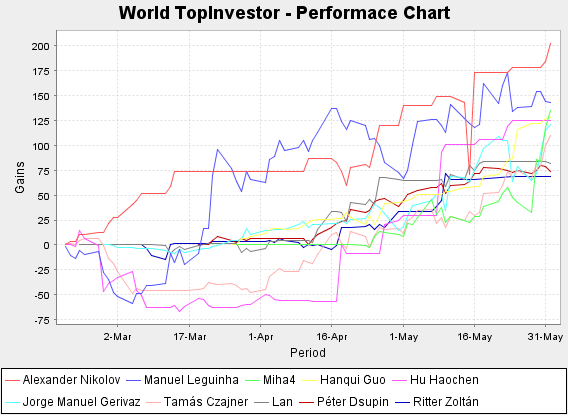

Still in the lead Alexander Nikolov with now gains over 200% followed by Manuel Leguinha and the newcomer Miha4 from Slovenia.