Greed is good or so we have been told. The World TopInvestor is also for those people but they have to be wised. It is a long competition going through a all cycle of time 12 months. Participants can use leverage, choose not to or do whatever they think is better to make money. The meltdown over the last month helped separating good investors from less good investors and aggressive investors from conservative investors. We saw some participants generating outsized returns whatever the risk entailed, and for some the risk was to great and they went broke.

The first half of the competition is finished. What can we expect in the next 6 months? It is unlikely this dislocation will last a great deal of time but if it were, the ramifications could be terrible, for the economy and for investors expecting new highs. Since 1994 there was no other period where we went more than four years without a serious correction.

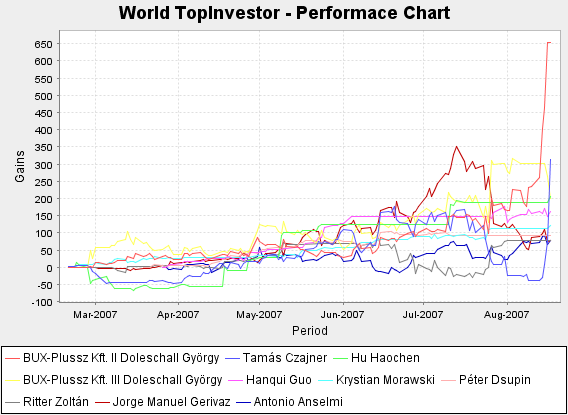

For now after six months we have a success story and that story is György Doleschall leader of World TopInvestor with gains over 600% in 6 months. The shake out this last week brought him fortunes being long JPY against TRY, NZD and HUF. Basically playing against the carry trades he increased his gains in the week from 233% to 653%. He had a good strategy too, locking the profits on his account III with gains surpassing 300% he continued to trade on his account II.

György Doleschall is not new. During his trading years he liked to play on the shake outs, he made huge gains on the equity markets during the crisis in 1997 and 1999. Now he proved that his strategy can work on the currency markets as well. So confident he was that he increased his positions while the market was moving into his direction, so he could leverage his profits.

In Slovenia the best performance has been shown by 31-years-old chemist Ales Klavzar who managed to climb on the top of the local rankings in the second week of the competition and was for a while placed on the top of world rankings from the second to the 8th week. He is only trading with a limited number of instruments he is familiar with, which is also known as the Zulu principle. That is why in the beginning of the competition he was only focused on ten shares and four Forex pairs, which held him on the top of the local rankings for nine weeks in a row. Later on, he dropped out of the top 5 only to return to the top in July.

From the very beginning of the World Top Investor the Bulgarian league was divided in two types of traders. The first group was the Forex traders. They proved to be very aggressive, using high leverage and achieve huge gains. They held the lead for a long time, even though some of them went in negative territory from the first month of the competition. Alexander Nikolov was the most experienced and well rounded investor among them. He made 79 consecutive winning trades and led not only the Bulgarian ranking but remained at the world top for a few weeks. Unfortunately the change in sentiment for the British economy and the massive up move of the sterling against all major currencies caught Alexander unprepared. His expectations of corrective move that would bring his position to profit were not justified and he lost all of his gains together with half of his initial capital. That was the end of the ruling times for Forex traders in the Bulgarian league.

The second group of traders was stock and CFD traders. They had modest gains compared with the highest achievement by Alexander Nikolov at 217.21%, who was in fact one of the few successful forex traders in the competition. Through most of the time the second and third place were taken by stock and CFD traders. Their balanced strategy turned out better and was rewarded during the run up of the equity markets worldwide from the beginning of the second quarter of the year through mid-July. They were competing on more equal ground as the lead position kept changing hands. Most often the first place was shared between Kostadin Trendafilov and Boyan Vassilev.

In Denmark two names have been regulars at the top: Hu Haochen and Hanqui Guo. These names have also been regularly among the Top10 at World level. They finish the first 6 months of the competition with gains of 205% and 160%.

The markets have gone through different stages in the first six months of the competition. The period of historic lows for the US dollar and the carry trade boom was also the time of new all-time highs for Dow Jones Industrial and multiyear highs for major stock indices. The Portuguese Manuel Leguinha did very well during that period. Using all his leverage he quickly reached gains over 100%. However we all know the market can move in two directions and the other direction proved to be fatal for his account. Jorge Manuel Gerivaz replaced him in the lead has been there since. With exposure to oil companies and asian companies he lead the world rankings with gains of 300%. The beginning of the global liquidity crisis wiped out a big portion of his gains. Jorge Manuel Gerivaz is ninth at World level with gains of 76%.

This is the time when the experienced and balanced investors will do better and we look forward to their performance in the next six months