The bull market did not resume this past week although he bounced from previous lows. The headlines were probably responsible for that, with lower consumer confidence, subprime fallouts and higher inflation. Investors now realize there is inflation after all. So the market is trying to stabilize but investors are getting confused with the direction of the american economy. Some think the mid week rebound was due to quadruple expiration last friday with traders avoiding the market to go down significantly, but only time will tell.

In China the potential is set for a floating of the Chinese Yuan in 2007. Over the weekend China raised rates for the third time in the past eleven months. In China like in the US inflation is a concern, but while Chinese can raise rates to slow down the economy in the US the subprime crisis will do just that.

Is this correction over, and can investors jump in with confidence? And what about the yen carry trade that everybody is talking about? Can we assume that if investors are willing to take the risk of keeping this trade there is no threat on global assets?

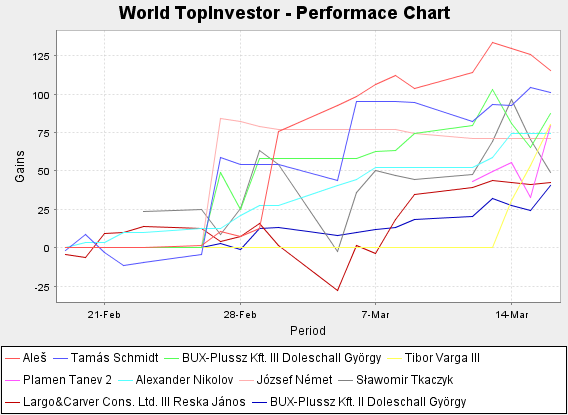

Difficult to say. In Hungary last week was full of excitment, even with the National Holiday in thursday. Two participants had a chance to taste the feeling of being with gains above 100%.

György Doleschall took the first place from Tamás Schmidt last week by going long in EURUSD, short in EURTRY and short in EURHUF. The former chess master is still holding his long EURUSD but unfortunately reversed his last two trades too early so the strengthening of HUF and TRY forced him back to the second place by the end of the week.

Tamás Schmidt on the peak again by shorting EURHUF and USDHUF which both fell on Friday. After a short break he is busy again trading GBPNOK, GBPCZK and the CAC40 index. His diversification strategy has not changed a lot, trading in more products, risking only a small portion of his capital.

Tibor Varga on his account III has climbed to the third place by holding his long position in XAGUSD. His first trade was successful enough to get him among the first three in Hungary.

József Német fell to the fourth place from the long held second trading solely the kiwiyen. Trying both sides he was short the cross on his latest trade which made him a small profit.

In the Bulgarian League two participants entered the top 10 in the overall standing of World Top Investor. Plamen Tanev 2 with 79.83% and Alexander Nikolov with 74.06% currently take 5-th and 6-th place. During the week Alexander Nikolov reached 3-rd place with his remarkable 74.06% gain and no losing trades until now.

In the Bulgarian League, the competition was very tense as the first two places were shared between Alexander and Plamen. Both participants prefer the Forex market with quick trades within the day, as the most traded currency by them is the British pound and its crosses with the majors.

In the last trading day Plamen managed to get ahead of Alexander and keep his advantage with realized gains of 79.83%. Plamen benefited from the sharp fall in GBP/JPY and besides that sold CFDs for the NASDAQ and FTSE 100 indices. In the coming week he expects the British pound to strengthen and predicts range trading in the stock market, where in his opinion the downtrend will continue for now, mostly due to the global weakness and withdrawal of capitals in the face of the threat of deepening of the crisis.

The leader of the World League and leader of the Slovenian League remains Ales with gains of 115%.